Ensure a Smooth and Hassle-free Australian Online Tax Return Filing Refine

Ensure a Smooth and Hassle-free Australian Online Tax Return Filing Refine

Blog Article

Explore Just How the Online Tax Obligation Return Process Can Simplify Your Tax Obligation Filing

The online tax return process has transformed the method people approach their tax obligation filings, supplying a level of ease that traditional methods typically do not have. By leveraging straightforward software program, taxpayers can browse the intricacies of tax obligation preparation from the comfort of their homes, considerably minimizing the time and initiative included.

Advantages of Online Tax Filing

The advantages of online tax filing are various and considerable for taxpayers seeking effectiveness and accuracy. One primary advantage is the ease it supplies, permitting people to finish their tax returns from the comfort of their own homes at any moment. This gets rid of the need for physical trips to tax obligation workplaces or waiting in lengthy lines, therefore saving valuable time.

An additional prominent advantage is the speed of processing; electronic submissions generally lead to quicker reimbursements contrasted to standard paper filings. Taxpayers can additionally profit from boosted security measures that protect sensitive individual info throughout the declaring procedure.

Additionally, on-line filing systems commonly supply access to different sources, including tax ideas and FAQs, equipping taxpayers to make enlightened choices. Australian Online Tax Return. Generally, these advantages add to a structured declaring experience, making online tax submitting a recommended choice for lots of people and businesses alike

Step-by-Step Filing Process

To efficiently navigate the online income tax return procedure, taxpayers can follow a simple, detailed strategy. Initially, individuals should collect all essential documentation, including W-2 types, 1099s, and receipts for deductions. This prep work ensures that all pertinent financial information is readily available.

Next, taxpayers need to select a credible on-line tax obligation software program or system. Several alternatives exist, so it is crucial to pick one that fits individual demands, consisting of individual experience and the complexity of the tax situation. Once the software program is picked, customers must produce an account and input their personal information, such as Social Security numbers and declaring status.

Taxpayers should very carefully comply with triggers to make certain accuracy. After finishing these areas, it is necessary to review the info for omissions or mistakes.

Usual Features of Tax Obligation Software

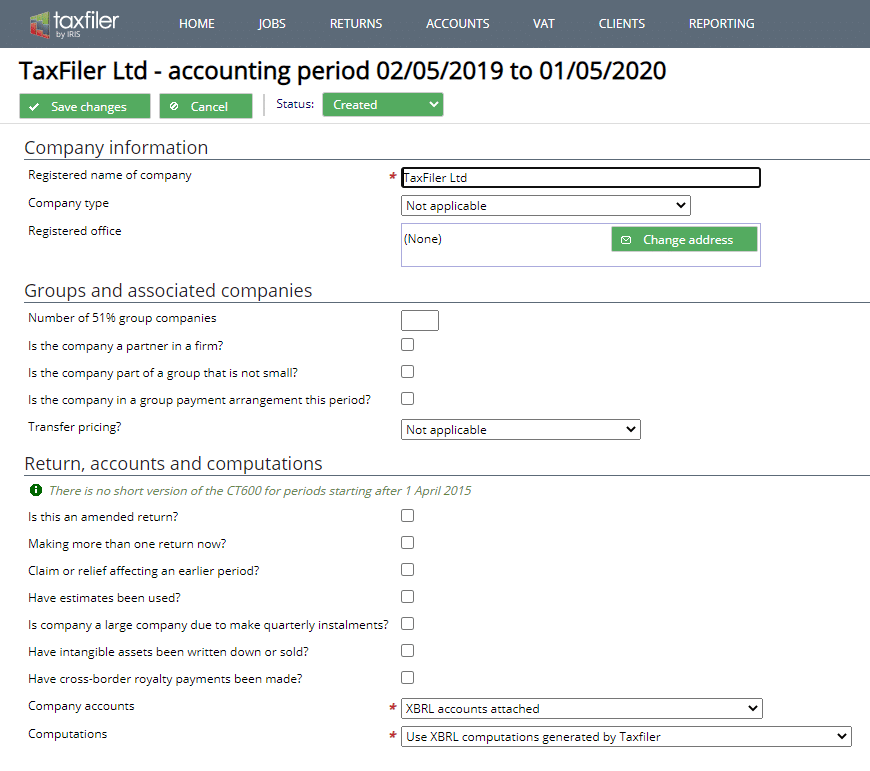

Tax software application commonly integrates a range of attributes developed to streamline the filing procedure and boost user experience. One of one of the most noteworthy attributes is user-friendly interfaces that lead taxpayers through each step, making certain that also those with limited tax understanding can browse the intricacies of tax obligation prep work.

Additionally, numerous tax obligation software application offer automated data entry, enabling individuals to import monetary info straight from different resources, such as W-2 forms and bank statements, which substantially minimizes the opportunities of mistakes. Some systems likewise supply real-time mistake monitoring, informing customers anchor to possible blunders prior to entry.

Moreover, tax obligation software application commonly consists of tax calculators that help estimate potential refunds or liabilities, enabling customers to make enlightened choices throughout the filing process. Many applications additionally include robust tax reduction and credit report finders that examine user inputs to identify relevant tax obligation benefits, taking full advantage of potential financial savings.

Protection and Privacy Measures

Making certain the safety and privacy of delicate monetary information is extremely important in the on-line income tax return procedure. Tax obligation prep work services make use of sophisticated encryption procedures to protect information during transmission. This security makes sure that personal info stays inaccessible to unapproved parties, substantially decreasing the threat of data violations.

Moreover, reputable tax software program providers execute multi-factor authentication (MFA) as an included layer of protection. MFA requires individuals to validate their identification through several networks, such as a text message or e-mail, prior to accessing their accounts. This step not just boosts safety and security yet also assists in protecting against unauthorized access.

Furthermore, many platforms abide by sector standards and policies, such as the Settlement Card Sector Data Safety And Security Criterion (PCI DSS) and the General Information Security Regulation (GDPR) Conformity with these laws ensures that individual data is taken care of sensibly and minimizes the risk of misuse. - Australian Online Tax Return

Routine safety and security audits and susceptability analyses are executed by these systems to recognize and address potential weaknesses. By integrating these safety and security steps, the on the internet income tax return process fosters a secure environment, allowing users to file their tax obligations with self-confidence, recognizing that their delicate details is shielded.

Tips for a Smooth Experience

Keeping protection and privacy during the on the internet tax return process lays the structure for a smooth experience. To attain this, start by selecting a respectable tax obligation software application or company that employs solid security and information protection measures. Ensure that the picked platform is compliant with internal revenue service regulations and provides safe login choices.

Organize your documents ahead of time to lessen tension during the declaring procedure. Gather W-2s, 1099s, and any kind of various other relevant tax obligation papers, categorizing them for very easy gain access to. Australian Online Tax Return. This preparation not just accelerates the process yet likewise reduces the chance of missing out on essential details

Furthermore, take the time to ascertain all entrances prior to submission. Mistakes can cause delays and prospective audits, so an extensive review is vital. Utilize integrated Discover More Here error-checking devices used by many tax software application, as these can catch usual mistakes.

Last but not least, file your tax obligation return as very early as possible. Early submitting allows more time for any kind of required adjustments and may quicken your reimbursement. Complying helpful resources with these pointers will assist make certain a reliable and seamless on-line tax return experience, eventually streamlining your tax obligation filing journey.

Verdict

The online tax return process has actually changed the means people approach their tax filings, providing a level of comfort that typical methods frequently lack.The advantages of on the internet tax obligation declaring are countless and significant for taxpayers seeking effectiveness and accuracy. Complying with these ideas will aid make sure a effective and seamless on the internet tax return experience, eventually simplifying your tax filing journey.

In conclusion, the online tax return procedure offers significant advantages that streamline the tax obligation declaring experience. By leveraging the advantages of on the internet tax filing, individuals can optimize their possible cost savings while lessening the stress usually connected with conventional filing methods.

Report this page